Sidra Chain appears as a cutting-edge solution at the nexus of Islamic finance and peer-to-peer technology. Conceived to assist a global audience seeking Shariah-aligned financial options, the platform incorporates ethical compliance into each layer of its system. By applying the prohibition of interest (riba), excessive vagueness (gharar), and investments in restricted industries, Sidra Chain differentiates itself from conventional chains which operate without consideration to religious or ethical principles.

Core Architecture and Control

At its heart, Sidra Chain is a Proof‑of‑Work blockchain that began as a fork of Ethereum in 2022. The network’s mainnet went live in October 2023, marking a important turning point in its journey toward a fully operational, Shariah‑compliant environment. This basic layer maintains the transparency and integrity hallmarks of traditional PoW systems while introducing administration mechanisms to guarantee that all transactions and smart contracts adhere to Islamic legal tenets.Beyond its decision-making model, Sidra Chain integrates Know Your Customer (KYC) protocols via KYCPORT, ensuring statutory adherence without limiting decentralization. This fusion of on‑chain governance and off‑chain verification places Sidra Chain as a bond between the trustless mindset of blockchain and the accountability demanded by financial regulators and Shariah experts.

This Sidra Framework: Coin, Bank, and Circles

Sidra Chain’s environment is composed of three integrated components: the Sidra Chain Network, Sidra Coin (SDA), and Sidra Bank. The network layer manages smart codes and transaction confirmation, while Sidra Coin serves as the native medium of exchange, mining reward, and fee unit. Sidra Bank functions as a decentralized money layer, offering low‑fee transfers and a suite of Shariah‑compliant financial instruments.With over 780 million SDA tokens in supply and a mobile app that crossed one million downloads, the platform reveals both scale and inclusiveness. A portion of the total token supply has been assigned for philanthropy—Islamic charitable giving—underscoring Sidra Chain’s commitment to social responsibility and community development.

Central to its spread strategy is SidraClubs, a network of local partners obligated for registration, KYC/AML compliance, payment gateway integration, and Shariah sanction. Through initiatives like SidraStart, which promotes ethical businesses, and blockchain‑based inheritance management, SidraClubs builds a structured framework for global growth that continues faithful to Islamic principles.

Tangible Applications and Effect

Sidra Chain’s design caters a range of practical use cases with immediate applicability to Muslim‑majority regions and worldwide. Cross‑border payments on the network eradicate intermediaries and reduce costs, offering an efficient remittance channel for migrant workers and visitors. In supply chain management, the immutable ledger affirms traceability of halal products, giving consumers assurance in compliance with dietary and ethical standards. For fundraising, the platform powers profit‑and‑loss sharing models that substitute conventional interest‑bearing loans, opening new avenues for Shariah‑compliant capital creation.Various industries exist to profit from Sidra Chain’s capabilities. Islamic banking institutions can Sidra chain Login capitalize on its infrastructure to roll out innovative Sukuk (Islamic bonds) and Murabaha (cost‑plus‑profit) products. Logistics and halal food producers gain enhanced openness, while non‑profit organizations can handle donations with greater accountability, inspiring donors about the proper use of charitable donations.

Challenges and Imminent Outlook

Despite its promise, Sidra Chain confronts growing pains typical of emerging blockchains. User feedback indicates occasional glitches in the mobile app—such as login failures and KYC processing delays—that can impede seamless participation. Moreover, the network’s relatively modest size compared to giants like Bitcoin and Ethereum confines liquidity and developer engagement, presenting hurdles to mainstream embracement.Looking ahead, Sidra Chain aims to expand its feature set with advanced smart‑contract tools and expanded Shariah‑compliant financial products. Educational initiatives and developer grants through SidraClubs are prepared to bolster ecosystem growth. If technical refinements and broader partnerships proceed as planned, Sidra Chain could initiate a new era of inclusive, ethical finance that overcomes regional boundaries and connects with users across continents.

In a landscape crowded with blockchain projects, Sidra Chain’s steadfast focus on Shariah compliance, accessible mining, and community‑driven expansion may create out a sustainable niche. As it manages technical challenges and scales its ecosystem, the Sidra chain Login platform’s evolution will be closely observed by both Islamic finance practitioners and the broader copyright sphere.

Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Nancy McKeon Then & Now!

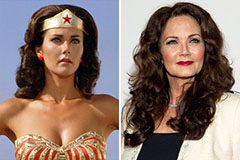

Nancy McKeon Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!